Demystifying the SPAC Map: A Comprehensive Guide to Understanding Special Purpose Acquisition Companies

Related Articles: Demystifying the SPAC Map: A Comprehensive Guide to Understanding Special Purpose Acquisition Companies

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Demystifying the SPAC Map: A Comprehensive Guide to Understanding Special Purpose Acquisition Companies. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Demystifying the SPAC Map: A Comprehensive Guide to Understanding Special Purpose Acquisition Companies

The world of finance is constantly evolving, and one of the most recent and exciting developments is the rise of Special Purpose Acquisition Companies (SPACs). These unique financial vehicles have become increasingly popular, offering a distinct path for companies to go public. However, navigating the SPAC landscape can be complex, especially for those unfamiliar with its intricacies.

This comprehensive guide aims to demystify the SPAC map, providing a clear and informative understanding of what SPACs are, how they operate, and their potential benefits and drawbacks.

What are SPACs?

A SPAC, often referred to as a "blank check company," is a publicly traded shell company with no existing business operations. Its sole purpose is to raise capital through an initial public offering (IPO) to acquire an existing private company. Essentially, a SPAC is a vehicle designed to take a private company public through a merger or acquisition.

How SPACs Work:

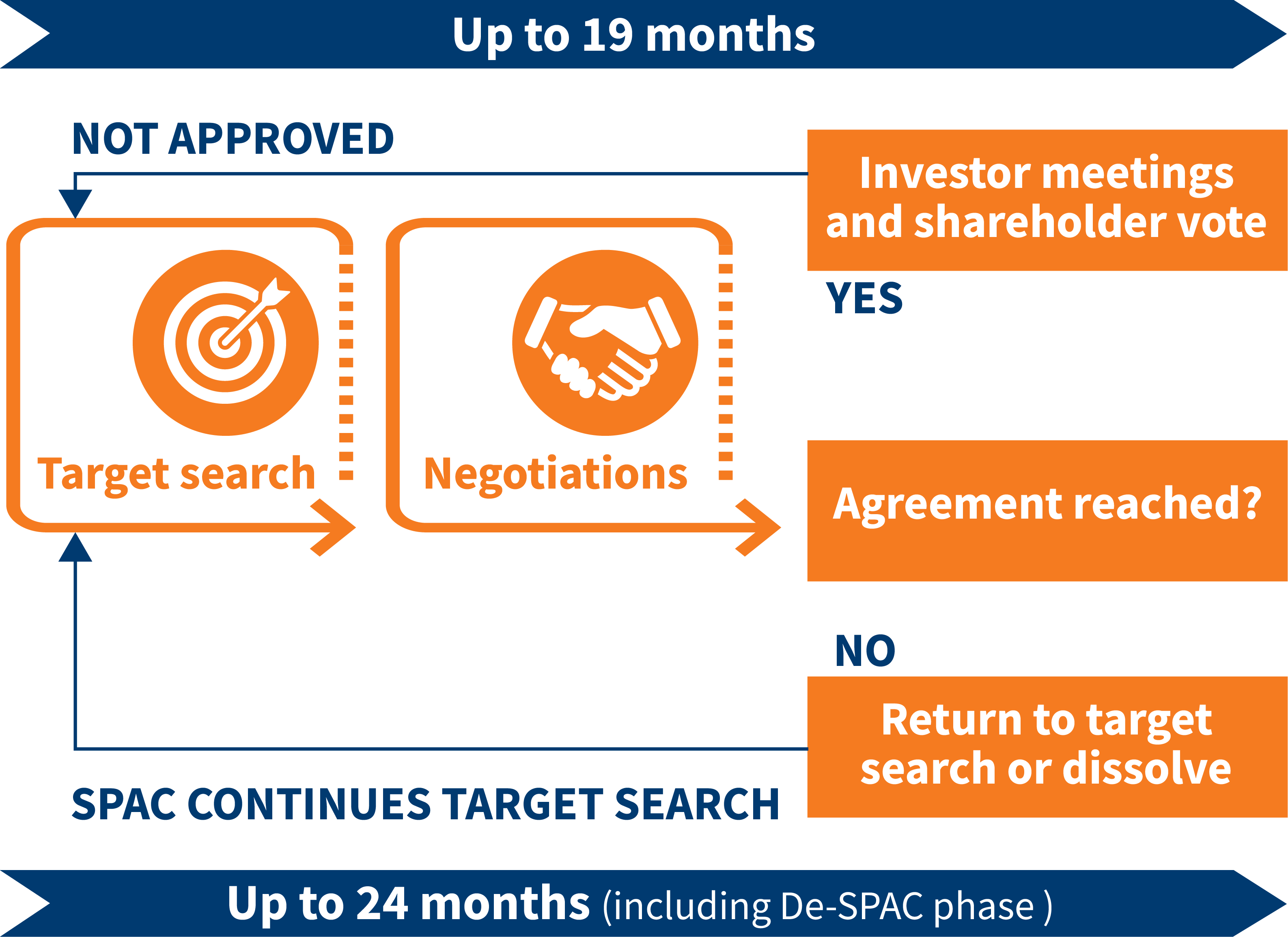

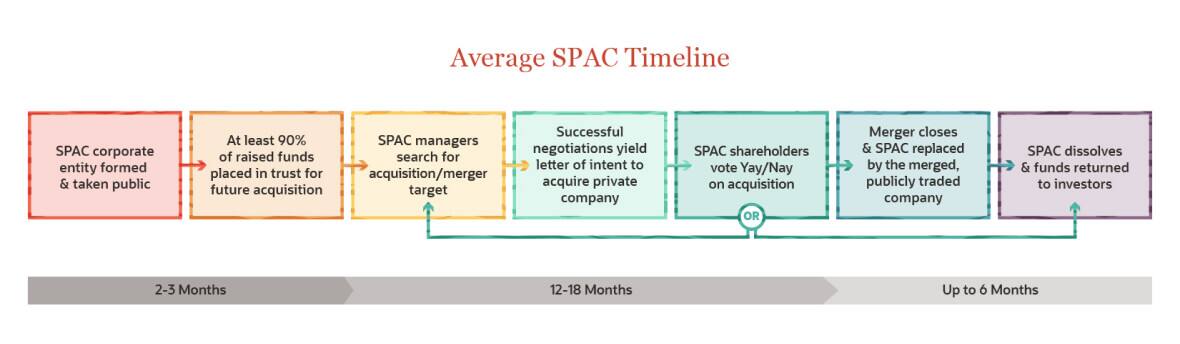

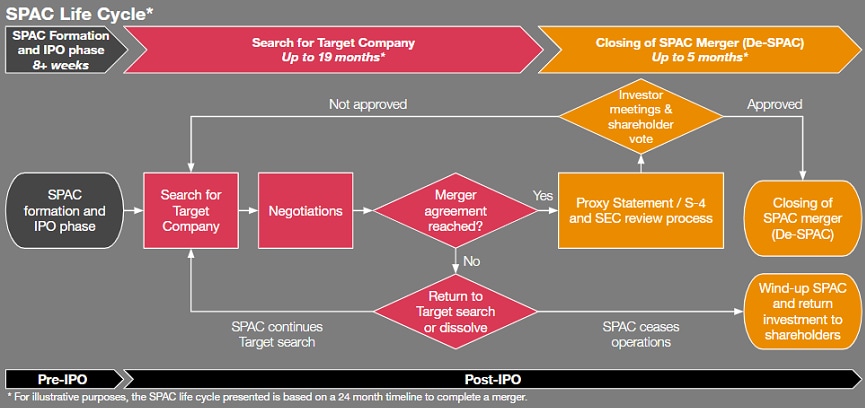

The process of a SPAC merger typically involves the following steps:

- SPAC Formation: A group of experienced individuals, often known as sponsors, form a SPAC and register it with the Securities and Exchange Commission (SEC).

- IPO: The SPAC raises capital through an IPO, selling shares to investors. The funds raised are held in a trust account until a suitable target company is identified.

- Target Identification: The SPAC’s management team actively searches for a private company to acquire. This process involves extensive due diligence and negotiations.

- Merger Agreement: Once a target company is chosen, the SPAC and the target company enter into a merger agreement. This agreement outlines the terms of the acquisition, including the exchange ratio of SPAC shares for target company shares.

- Shareholder Vote: The SPAC’s shareholders vote on the proposed merger. A majority vote is required for the merger to proceed.

- De-SPAC: Upon successful shareholder approval, the SPAC merges with the target company, creating a publicly listed entity. The target company’s shares begin trading on a public exchange.

Benefits of SPACs:

- Faster Access to Capital: SPACs can provide a quicker route to public markets compared to a traditional IPO. The process is typically shorter and less complex, allowing companies to access capital more efficiently.

- Reduced Regulatory Burden: The SPAC merger process generally involves less stringent regulatory scrutiny than a traditional IPO, making it a more streamlined option for companies.

- Enhanced Visibility: Going public through a SPAC can significantly raise the profile of a private company, attracting greater investor interest and media attention.

- Experienced Management: SPAC sponsors typically have a strong track record in finance and business, bringing valuable expertise to the merged entity.

Drawbacks of SPACs:

- Valuation Uncertainty: Determining the fair valuation of a target company can be challenging, potentially leading to overvaluation or undervaluation.

- Shareholder Dilution: The SPAC merger process often results in shareholder dilution, as existing shareholders may receive a lower proportion of the merged company’s shares.

- Limited Due Diligence: The compressed timeline of SPAC mergers can limit the extent of due diligence performed, potentially exposing investors to greater risks.

- Post-Merger Performance: The performance of SPAC-merged companies has been mixed, with some experiencing significant growth while others have struggled.

SPAC Map: Navigating the Landscape

The SPAC map is a visual representation of the SPAC market, providing insights into the current trends and dynamics within this rapidly evolving space. It typically includes data on:

- SPAC Activity: The number of new SPACs forming, the amount of capital raised, and the number of SPAC mergers completed.

- Industry Focus: The sectors and industries targeted by SPACs, highlighting areas of high interest and activity.

- SPAC Sponsor Profile: The track records and experience of SPAC sponsors, offering insights into their capabilities and success rates.

- Deal Performance: The post-merger performance of SPAC-merged companies, providing a measure of their success and potential risks.

Analyzing the SPAC Map:

By studying the SPAC map, investors can gain valuable insights into:

- Market Trends: Identifying emerging trends and areas of high SPAC activity can help investors make informed decisions.

- Investment Opportunities: The map can highlight promising SPACs and target companies with strong growth potential.

- Risk Assessment: Understanding the performance of SPACs and their sponsors can help investors assess the risks associated with SPAC investments.

FAQs about SPACs:

Q: What are the risks associated with SPAC investments?

A: Investing in SPACs carries inherent risks, including:

- Valuation Uncertainty: The valuation of the target company may be inaccurate, leading to overpayment or underpayment.

- Shareholder Dilution: Existing shareholders may experience dilution of their ownership stake after the merger.

- Limited Due Diligence: The compressed timeline of SPAC mergers can limit the due diligence process, potentially exposing investors to greater risks.

- Post-Merger Performance: The performance of SPAC-merged companies can be unpredictable, and some may fail to meet expectations.

Q: How can I invest in SPACs?

A: You can invest in SPACs by purchasing shares of the SPAC during its IPO or in the secondary market after the IPO. However, it is crucial to conduct thorough research and due diligence before making any investment decisions.

Q: What are the differences between SPACs and traditional IPOs?

A: While both SPACs and traditional IPOs involve taking a company public, they differ significantly in terms of process, timeline, and risks:

| Feature | SPAC | Traditional IPO |

|---|---|---|

| Process | Merger with a shell company | Direct offering of shares to the public |

| Timeline | Typically faster | Can be lengthy and complex |

| Regulatory Burden | Less stringent | More rigorous |

| Valuation | Determined by the merger agreement | Determined by market demand |

| Risk | Higher risk of valuation uncertainty and shareholder dilution | Higher risk of regulatory scrutiny and market volatility |

Tips for Investing in SPACs:

- Thorough Research: Conduct comprehensive due diligence on both the SPAC and the target company, including their financials, management team, and industry outlook.

- Sponsor Track Record: Evaluate the experience and success rate of the SPAC sponsors.

- Merger Agreement Review: Carefully review the merger agreement, paying attention to the exchange ratio, the amount of dilution, and any potential conflicts of interest.

- Post-Merger Performance: Monitor the performance of the merged company after the de-SPAC, assessing its financial performance and growth prospects.

- Diversification: Diversify your investment portfolio by investing in multiple SPACs across different sectors.

Conclusion:

SPACs offer a distinct path to public markets, providing companies with a faster and potentially less burdensome route to accessing capital. However, investors must be aware of the inherent risks associated with SPAC investments, including valuation uncertainty, shareholder dilution, and the potential for underperformance. By carefully analyzing the SPAC map and conducting thorough due diligence, investors can navigate this complex landscape and identify potentially promising opportunities.

The SPAC market is constantly evolving, and staying informed about the latest trends and developments is crucial for making informed investment decisions. With careful research and a well-defined investment strategy, investors can leverage the unique characteristics of SPACs to potentially enhance their portfolio returns.

:max_bytes(150000):strip_icc()/Spac-6b76535412b54c91b1e91ed54698ed24.png)

Closure

Thus, we hope this article has provided valuable insights into Demystifying the SPAC Map: A Comprehensive Guide to Understanding Special Purpose Acquisition Companies. We thank you for taking the time to read this article. See you in our next article!