Navigating Cullman County: A Comprehensive Guide to the Tax Map

Related Articles: Navigating Cullman County: A Comprehensive Guide to the Tax Map

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Cullman County: A Comprehensive Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating Cullman County: A Comprehensive Guide to the Tax Map

- 2 Introduction

- 3 Navigating Cullman County: A Comprehensive Guide to the Tax Map

- 3.1 What is the Cullman County Tax Map?

- 3.2 Understanding the Importance of the Tax Map

- 3.3 Exploring the Features of the Cullman County Tax Map

- 3.4 Accessing the Cullman County Tax Map

- 3.5 Frequently Asked Questions (FAQs)

- 3.6 Tips for Using the Cullman County Tax Map

- 3.7 Conclusion

- 4 Closure

Navigating Cullman County: A Comprehensive Guide to the Tax Map

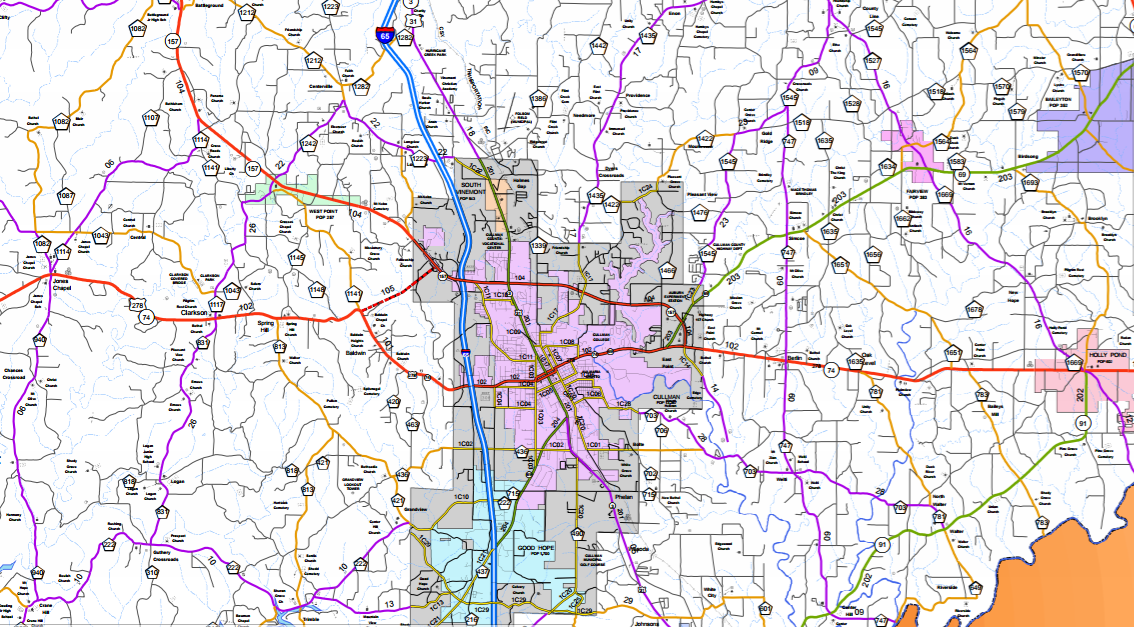

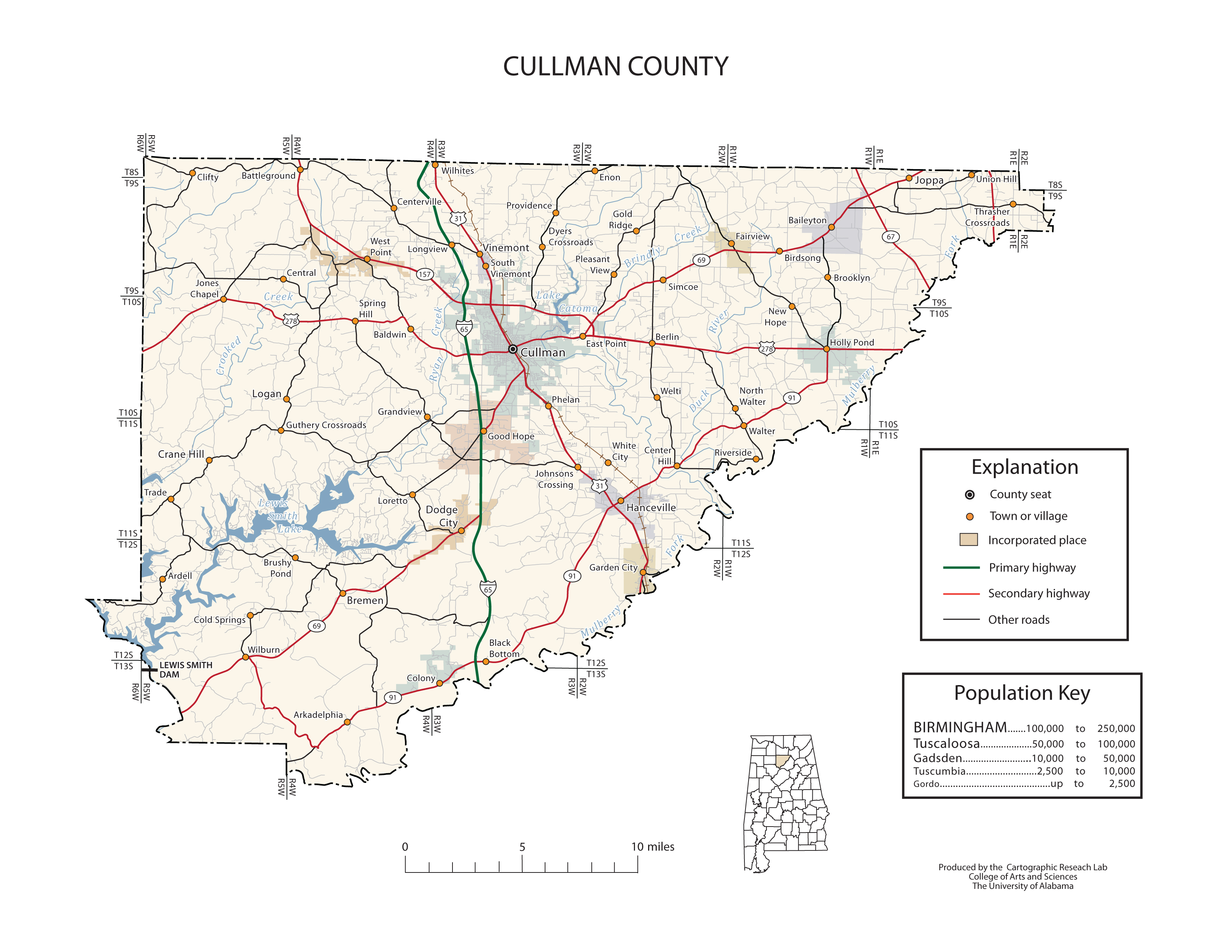

Cullman County, Alabama, a region rich in history and natural beauty, boasts a diverse landscape of residential, commercial, and agricultural properties. Understanding the layout and ownership of these properties is crucial for various purposes, including real estate transactions, property assessments, and even planning for future development. This is where the Cullman County Tax Map comes into play.

What is the Cullman County Tax Map?

The Cullman County Tax Map is a comprehensive visual representation of all taxable properties within the county. It serves as a vital tool for both the public and the Cullman County Tax Assessor’s Office. The map provides a detailed overview of property boundaries, ownership information, and property classifications, all organized in a user-friendly format.

Understanding the Importance of the Tax Map

The Cullman County Tax Map plays a crucial role in several key areas:

1. Property Assessment and Taxation: The map provides the foundation for property assessments, ensuring that each property is valued accurately based on its size, location, and type. This accurate assessment forms the basis for property taxes, ensuring fairness and transparency in the tax system.

2. Real Estate Transactions: Buyers, sellers, and real estate professionals rely on the tax map to verify property boundaries, identify potential easements, and confirm ownership details. This information is essential for smooth and accurate property transactions.

3. Planning and Development: The tax map serves as a valuable resource for planners and developers, providing insights into existing land use patterns, identifying potential areas for development, and understanding the availability of suitable properties.

4. Emergency Response: In case of emergencies, the tax map can be crucial for identifying property locations, accessing ownership information, and coordinating response efforts effectively.

5. Public Access to Information: The tax map promotes transparency and accountability by making property information readily available to the public. This allows citizens to understand the tax system, monitor property ownership changes, and participate in community development initiatives.

Exploring the Features of the Cullman County Tax Map

The Cullman County Tax Map is typically presented in a digital format, offering several interactive features:

1. Interactive Map Interface: Users can zoom in and out of the map, pan across different areas, and navigate to specific locations with ease.

2. Property Search: Users can search for properties by address, parcel number, or owner name.

3. Property Information: Each property entry provides detailed information, including:

* **Parcel Number:** A unique identifier for each property.

* **Owner Name:** The name of the current property owner.

* **Property Address:** The official address of the property.

* **Land Area:** The total size of the property in acres or square feet.

* **Property Type:** Residential, commercial, agricultural, or other.

* **Tax Assessment:** The assessed value of the property for tax purposes.

* **Tax Rate:** The applicable tax rate for the property.

* **Tax Due:** The total amount of property tax owed.4. Boundary Lines: The map clearly outlines the boundaries of each property, helping to avoid disputes and ensure accurate property measurements.

5. Geographic Information System (GIS) Integration: The tax map may be integrated with other GIS data layers, such as road networks, water bodies, and zoning information, providing a comprehensive view of the county’s landscape.

Accessing the Cullman County Tax Map

The Cullman County Tax Map is typically accessible through the website of the Cullman County Tax Assessor’s Office. The website provides detailed instructions on accessing the map, searching for properties, and interpreting the information provided.

Frequently Asked Questions (FAQs)

1. How can I find the tax map for a specific property in Cullman County?

You can access the Cullman County Tax Map through the website of the Cullman County Tax Assessor’s Office. The website usually provides a search function where you can enter the property address, parcel number, or owner’s name to locate the specific property.

2. What information can I find on the tax map?

The Cullman County Tax Map provides a wide range of information, including:

* Property boundaries

* Ownership details

* Property classifications

* Land area

* Tax assessment

* Tax rate

* Tax due3. How often is the tax map updated?

The Cullman County Tax Map is typically updated annually to reflect changes in property ownership, assessments, and other relevant information.

4. Is the tax map available in a printed format?

While the tax map is primarily accessible digitally, some counties may offer printed versions upon request. Contact the Cullman County Tax Assessor’s Office for details.

5. Can I use the tax map to determine property values?

The tax map provides the assessed value of each property for tax purposes, but it may not reflect the current market value. To obtain a more accurate assessment of property value, consult with a real estate professional.

Tips for Using the Cullman County Tax Map

1. Start with a Clear Search: Begin by entering the correct property address, parcel number, or owner’s name to ensure you are accessing the right information.

2. Zoom In for Detail: Use the zoom function to view the map at a closer scale, allowing you to examine property boundaries and other features more clearly.

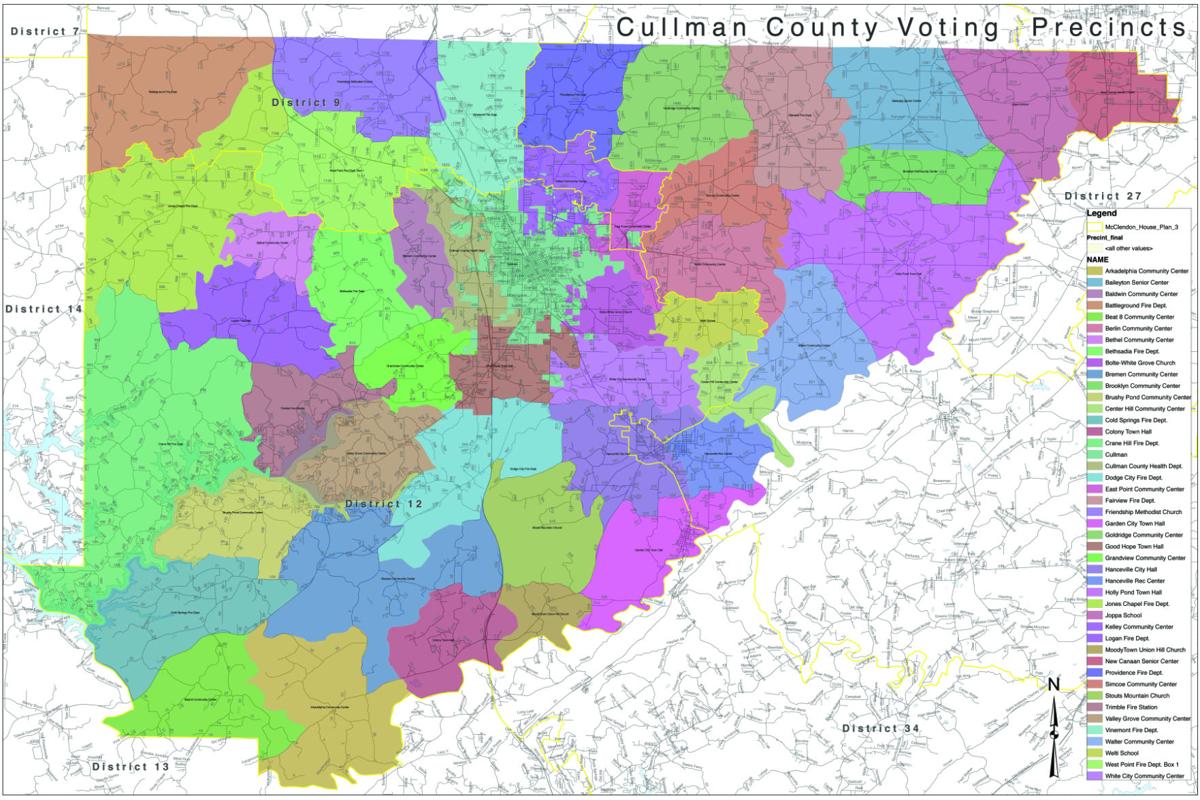

3. Understand the Legend: Pay attention to the map’s legend, which explains the symbols and colors used to represent different property types, ownership statuses, and other relevant information.

4. Verify Information: Cross-reference the information provided on the tax map with other reliable sources, such as property deeds or real estate listings, to ensure accuracy.

5. Seek Assistance: If you have any questions or difficulties using the tax map, contact the Cullman County Tax Assessor’s Office for assistance.

Conclusion

The Cullman County Tax Map serves as a valuable resource for a wide range of stakeholders, providing a comprehensive and accessible overview of property information within the county. Its importance lies in its ability to facilitate accurate property assessments, streamline real estate transactions, support planning and development initiatives, enhance emergency response efforts, and promote transparency in public information. By understanding the features and benefits of the tax map, residents, businesses, and government agencies can leverage its power to make informed decisions and navigate the complex world of property ownership and land use within Cullman County.

Closure

Thus, we hope this article has provided valuable insights into Navigating Cullman County: A Comprehensive Guide to the Tax Map. We thank you for taking the time to read this article. See you in our next article!