Navigating North Carolina’s Property Tax Landscape: A Comprehensive Guide to Tax Maps

Related Articles: Navigating North Carolina’s Property Tax Landscape: A Comprehensive Guide to Tax Maps

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating North Carolina’s Property Tax Landscape: A Comprehensive Guide to Tax Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating North Carolina’s Property Tax Landscape: A Comprehensive Guide to Tax Maps

- 2 Introduction

- 3 Navigating North Carolina’s Property Tax Landscape: A Comprehensive Guide to Tax Maps

- 3.1 What are North Carolina Tax Maps?

- 3.2 How are North Carolina Tax Maps Used?

- 3.3 Understanding the Structure of North Carolina Tax Maps

- 3.4 Accessing North Carolina Tax Maps

- 3.5 Navigating North Carolina Tax Maps: A User-Friendly Approach

- 3.6 FAQs about North Carolina Tax Maps

- 3.7 Tips for Using North Carolina Tax Maps

- 3.8 Conclusion

- 4 Closure

Navigating North Carolina’s Property Tax Landscape: A Comprehensive Guide to Tax Maps

Understanding property taxes is an essential part of owning real estate in North Carolina. The North Carolina Department of Revenue (DOR) employs a system of tax maps to facilitate this understanding. These maps are more than just visual representations; they serve as a vital tool for property owners, assessors, and other stakeholders, providing a detailed and organized overview of properties within the state.

What are North Carolina Tax Maps?

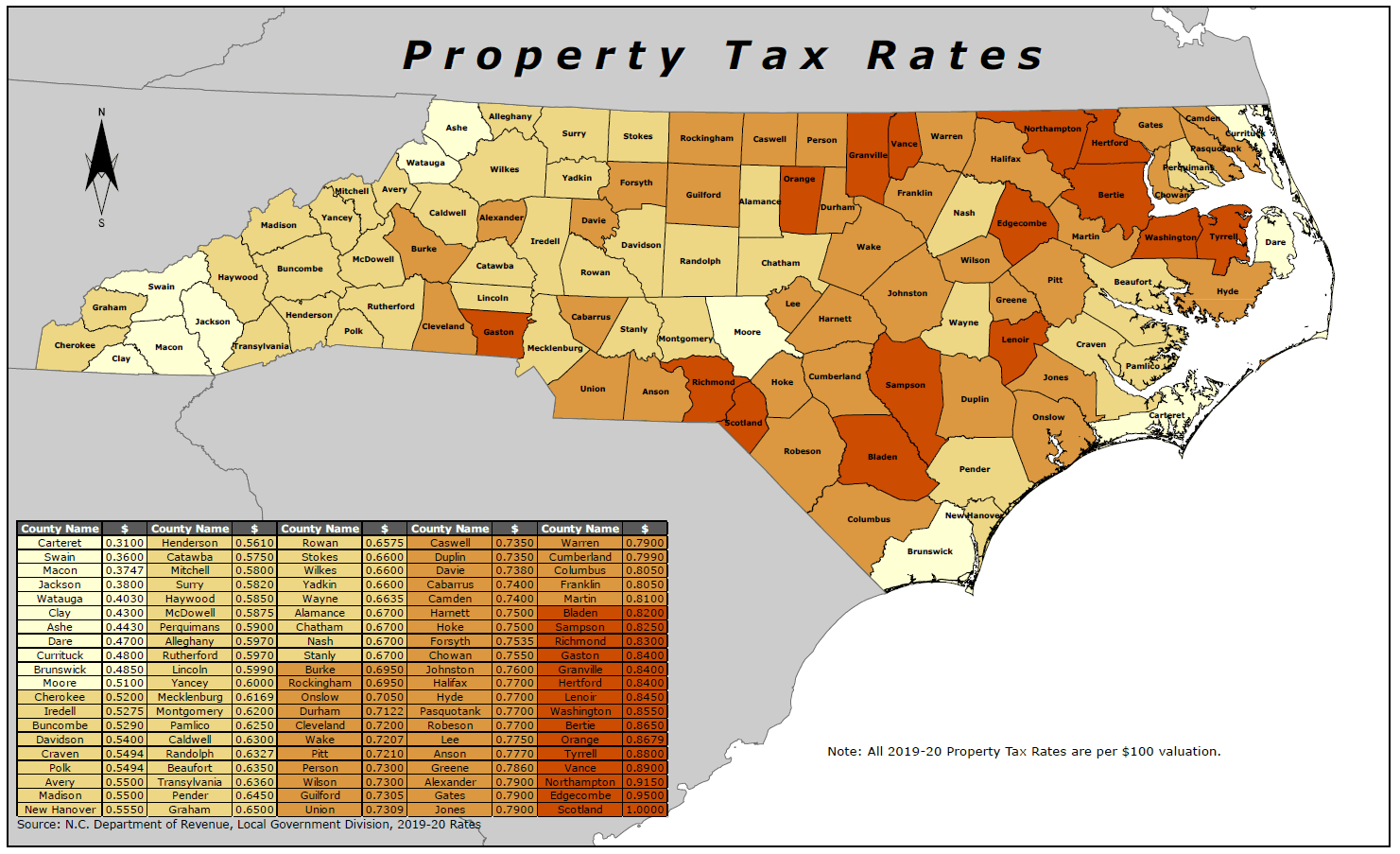

North Carolina tax maps are detailed, geographically referenced records that depict the location and characteristics of individual parcels of land within the state. These maps are crucial for the administration and collection of property taxes. They provide valuable information about:

- Property Boundaries: Clearly defined property lines, ensuring accurate assessment of property size and location.

- Ownership Information: Details about the legal owner of each parcel, facilitating communication and tax collection.

- Property Characteristics: Information about the type of property (residential, commercial, agricultural, etc.), its improvements, and its assessed value.

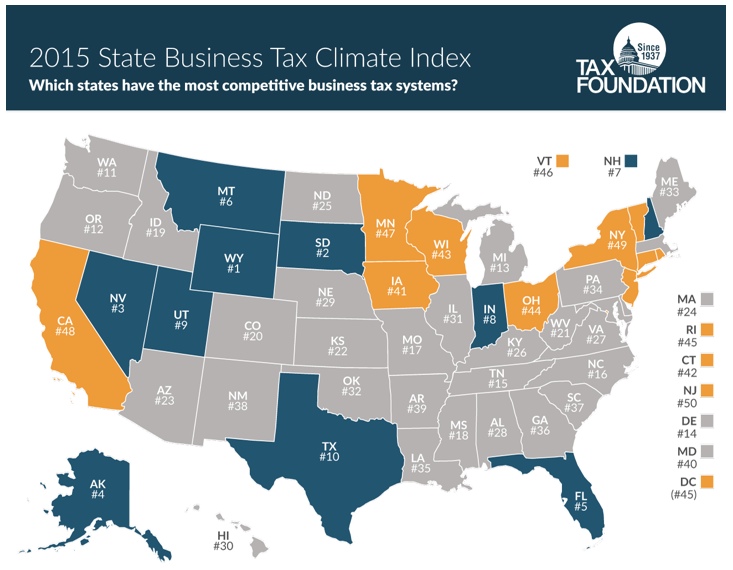

- Tax Rates and Assessments: The tax rate applied to each parcel, based on its classification and the local jurisdiction’s tax policies.

- Historical Data: Records of past property transactions, ownership changes, and assessments, providing valuable historical context.

How are North Carolina Tax Maps Used?

North Carolina tax maps serve a multitude of purposes, playing a crucial role in various aspects of property management and administration:

1. Property Assessment: County assessors utilize tax maps to accurately assess the value of properties for taxation purposes. The maps provide the necessary information to determine the property’s size, location, and improvements, allowing assessors to apply fair and consistent valuation methods.

2. Tax Collection: The DOR relies on tax maps to identify property owners and send out property tax bills. The maps ensure that property taxes are collected efficiently and equitably, contributing to the funding of essential public services.

3. Property Transactions: Real estate professionals, including real estate agents, appraisers, and title companies, use tax maps to verify property boundaries, identify potential issues, and facilitate property transactions.

4. Planning and Development: Local governments and developers utilize tax maps to understand the existing land use patterns, identify potential development opportunities, and plan for future growth.

5. Emergency Response: Emergency responders, such as firefighters and law enforcement, use tax maps to quickly locate properties and navigate effectively during emergencies.

6. Public Access and Transparency: North Carolina’s tax maps are publicly accessible, providing transparency into property ownership, assessments, and tax rates. This access empowers citizens to understand how their property taxes are calculated and to engage in local government decision-making processes.

Understanding the Structure of North Carolina Tax Maps

North Carolina tax maps are organized in a hierarchical structure, typically broken down into the following levels:

- County: The highest level, encompassing all the parcels within a specific county.

- Township: Dividing the county into smaller geographical areas.

- Tax District: Further subdividing townships into smaller areas for tax administration purposes.

- Parcel: The individual unit of land, representing a single property.

Each parcel on the tax map is assigned a unique identification number, known as the parcel ID number. This number serves as a primary key, allowing for easy referencing and retrieval of information about the property.

Accessing North Carolina Tax Maps

North Carolina’s tax maps are readily accessible to the public through various channels:

- County Tax Offices: Each county has a tax office that maintains and provides access to its tax maps.

- North Carolina Department of Revenue (DOR): The DOR website offers online access to property tax records, including tax maps, for all counties in the state.

- Third-Party Websites: Several private companies and websites offer access to property data, including tax maps, for a fee.

Navigating North Carolina Tax Maps: A User-Friendly Approach

While tax maps are essential tools for property management and administration, they can sometimes appear complex to the untrained eye. However, with a basic understanding of the key elements and a few simple tips, navigating tax maps becomes a straightforward process:

- Identify the County: Determine the county where the property is located.

- Locate the Township or Tax District: Once the county is identified, pinpoint the specific township or tax district where the property resides.

- Find the Parcel ID Number: Use the property’s address or legal description to locate the corresponding parcel ID number on the map.

- Interpret the Map Information: Carefully review the information associated with the parcel, including property boundaries, ownership details, and assessed value.

- Utilize Online Tools: Online mapping platforms often offer interactive features, such as zoom, pan, and search functionality, making it easier to navigate and explore tax maps.

FAQs about North Carolina Tax Maps

1. How can I find the tax map for my property?

The most reliable method is to contact your county’s tax office. They can provide you with a physical copy of the tax map or direct you to online resources.

2. What information is included on a tax map?

North Carolina tax maps typically include property boundaries, ownership information, property characteristics, tax rates, and assessments.

3. How often are tax maps updated?

Tax maps are typically updated annually to reflect changes in property ownership, boundaries, and assessments.

4. Can I make changes to the tax map?

Changes to tax maps are typically made by the county assessor’s office. If you believe there is an error on the map, you should contact the assessor’s office to request a correction.

5. Are tax maps available for free?

Access to tax maps is generally free through county tax offices and the North Carolina Department of Revenue website. However, some third-party websites may charge a fee for access.

6. What if I can’t find my property on the tax map?

If you cannot find your property on the tax map, contact the county assessor’s office for assistance. They can help you identify the correct parcel and resolve any discrepancies.

Tips for Using North Carolina Tax Maps

- Familiarize yourself with the map’s legend: Understanding the symbols and abbreviations used on the map will enhance your ability to interpret the information effectively.

- Use online tools for enhanced navigation: Interactive mapping platforms provide features such as zoom, pan, and search, making it easier to locate specific properties and information.

- Consult with professionals for complex situations: If you encounter difficulties understanding or interpreting the tax map, seek guidance from a real estate professional, appraiser, or legal expert.

- Keep track of map updates: Stay informed about any changes or updates to the tax maps by checking the county assessor’s office website or contacting them directly.

Conclusion

North Carolina tax maps are indispensable tools for understanding and navigating the state’s property tax landscape. By providing a comprehensive overview of property ownership, boundaries, and assessments, these maps empower property owners, assessors, and other stakeholders to make informed decisions and ensure fair and equitable taxation. Whether you are a property owner, a real estate professional, or a citizen interested in local government affairs, understanding and utilizing North Carolina tax maps is crucial for navigating the complex world of property ownership and taxation.

Closure

Thus, we hope this article has provided valuable insights into Navigating North Carolina’s Property Tax Landscape: A Comprehensive Guide to Tax Maps. We hope you find this article informative and beneficial. See you in our next article!