Navigating Property Information in Santa Fe County: A Guide to the Assessor’s Map

Related Articles: Navigating Property Information in Santa Fe County: A Guide to the Assessor’s Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Property Information in Santa Fe County: A Guide to the Assessor’s Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Property Information in Santa Fe County: A Guide to the Assessor’s Map

The Santa Fe County Assessor’s Office plays a crucial role in property valuation and taxation. A key tool employed by the office is the Assessor’s Map, a digital resource that provides a comprehensive overview of property boundaries, ownership information, and tax assessment details within Santa Fe County. This map serves as a vital resource for property owners, potential buyers, investors, and various stakeholders involved in real estate transactions.

Understanding the Assessor’s Map: A Comprehensive Overview

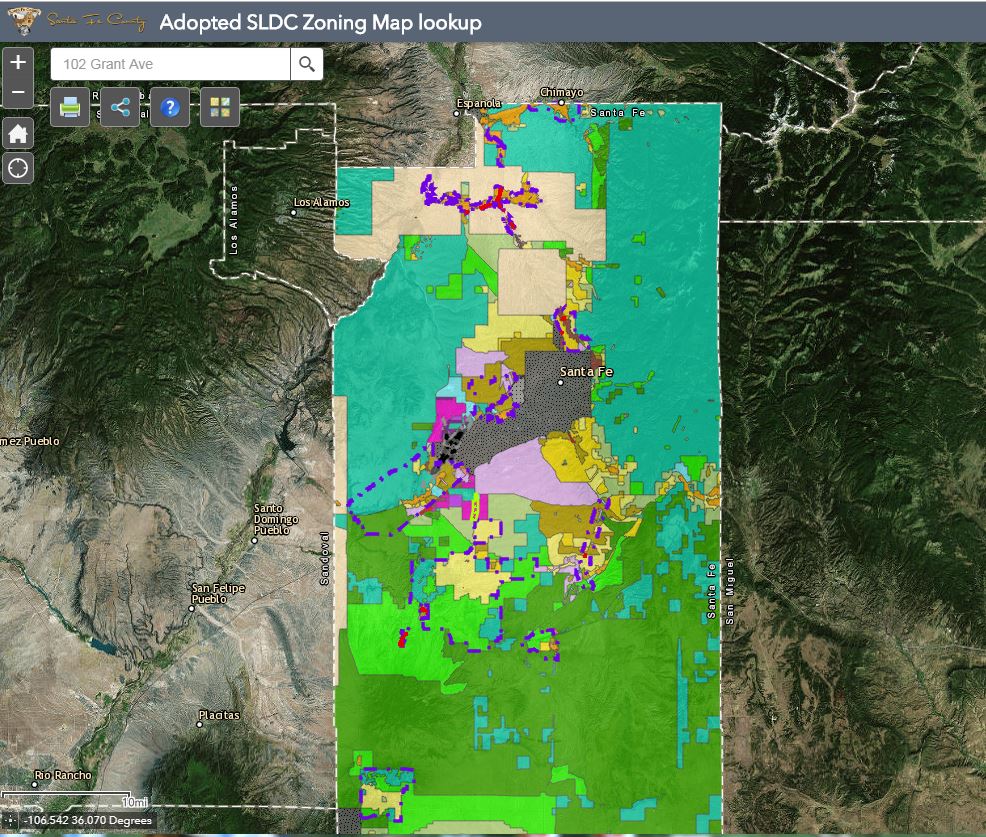

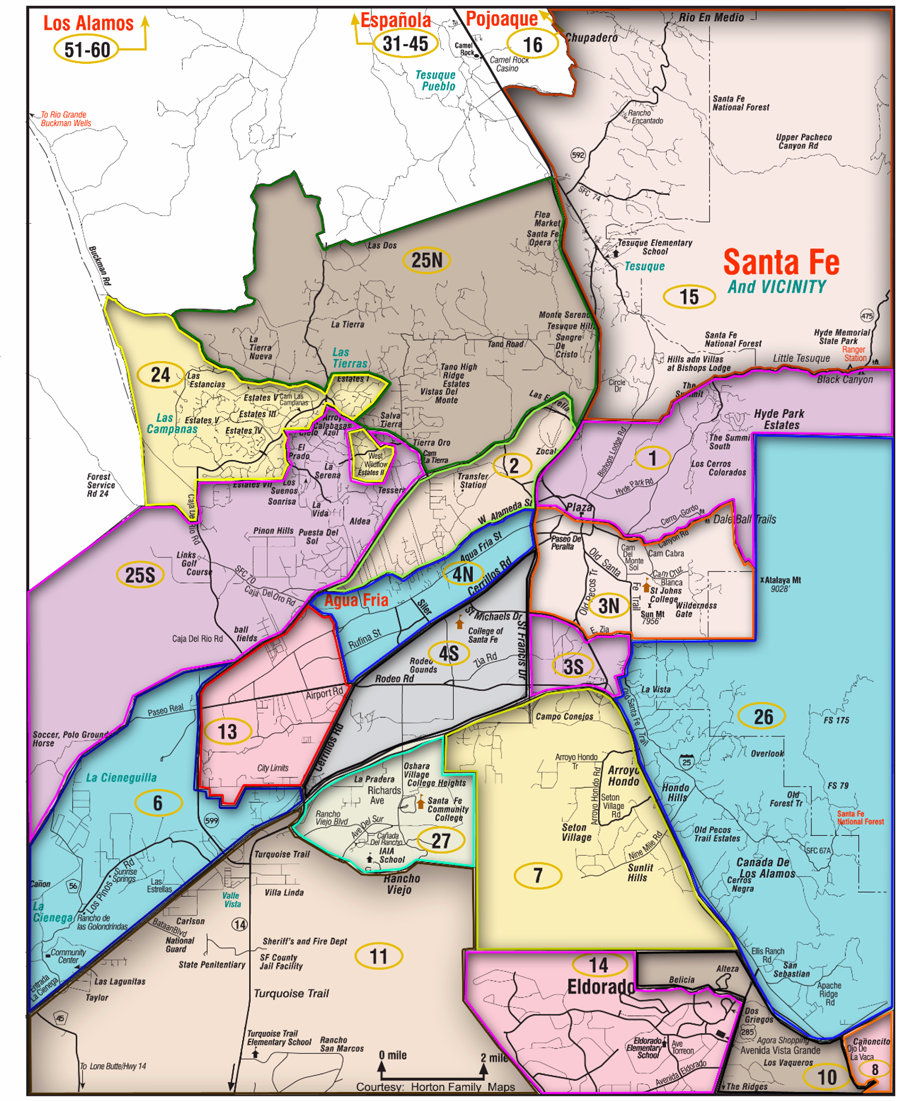

The Santa Fe County Assessor’s Map is an interactive, online tool that allows users to explore property information with ease. It functions as a digital representation of the county’s land parcels, overlaying property data onto a geographical base map. This integration of spatial and property information makes it a powerful tool for understanding land ownership, property values, and tax assessments.

Key Features and Functionality

The Assessor’s Map boasts a user-friendly interface that allows users to navigate and explore property information efficiently. Key features include:

- Interactive Map Interface: The map allows users to zoom in and out, pan across the county, and explore specific areas of interest.

- Property Search: Users can search for specific properties by address, parcel number, owner name, or other relevant criteria.

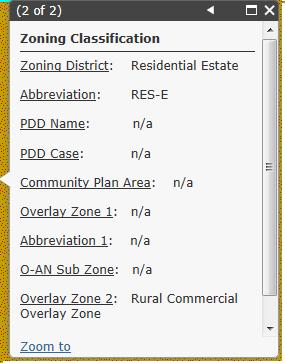

- Property Details: Clicking on a property marker reveals detailed information about the parcel, including ownership, legal description, property type, assessed value, and tax information.

- Property History: The map may provide access to historical property records, such as past ownership transfers and assessment changes.

- Tax Information: Users can access tax information for specific properties, including current tax bills, payment history, and tax exemptions.

- Layers and Filters: The map often allows users to customize their view by toggling various layers, such as zoning information, floodplains, or other relevant data.

Benefits of Utilizing the Assessor’s Map

The Santa Fe County Assessor’s Map offers numerous benefits for a wide range of users:

- Property Owners: Property owners can use the map to verify their property details, access tax information, and understand their property value.

- Potential Buyers: Prospective buyers can use the map to identify properties of interest, explore property boundaries, and access relevant information before making an offer.

- Real Estate Professionals: Real estate agents, brokers, and appraisers can utilize the map to research properties, assess market trends, and gather data for their clients.

- Investors: Investors can use the map to identify potential investment opportunities, analyze property values, and assess tax implications.

- Government Agencies: The map serves as a valuable tool for government agencies, such as planning departments, emergency services, and tax assessors, to manage and analyze land use data.

Navigating the Map: A Step-by-Step Guide

Accessing and using the Santa Fe County Assessor’s Map is straightforward. Here’s a step-by-step guide:

- Visit the Santa Fe County Assessor’s Website: Navigate to the official website of the Santa Fe County Assessor’s Office.

- Locate the Assessor’s Map: Look for a section on the website labeled "Assessor’s Map" or "Property Search."

- Access the Map: Click on the link to open the interactive map interface.

- Search for a Property: Use the search bar to enter the address, parcel number, or owner name of the property you’re interested in.

- Explore Property Details: Click on the property marker to view detailed information about the parcel, including ownership, legal description, assessed value, and tax information.

- Utilize Map Features: Utilize the map’s tools to zoom in and out, pan across the county, and explore specific areas of interest.

- Customize Your View: Toggle various layers and filters to customize your view and access specific data points.

Frequently Asked Questions (FAQs)

Q: How do I find my property on the Assessor’s Map?

A: You can search for your property by address, parcel number, or owner name using the search bar provided on the map interface.

Q: What information can I access about my property on the map?

A: The map provides information such as ownership, legal description, property type, assessed value, tax information, and potentially historical records.

Q: How can I update my property information with the Assessor’s Office?

A: Contact the Santa Fe County Assessor’s Office directly to request updates to your property information. They may require specific documentation to process the update.

Q: What if I can’t find my property on the map?

A: If you’re unable to locate your property on the map, contact the Santa Fe County Assessor’s Office for assistance. They can help you identify the correct parcel and provide any necessary guidance.

Q: What are the legal descriptions used on the map?

A: The legal descriptions used on the map are based on the official land survey records for Santa Fe County. These descriptions typically include information such as township, range, section, and lot numbers.

Q: How are property values determined on the map?

A: Property values are determined by the Santa Fe County Assessor’s Office through a process of assessment that considers factors such as property type, size, location, and market conditions.

Tips for Utilizing the Assessor’s Map

- Familiarize Yourself with the Interface: Spend some time exploring the map’s features and functionality before conducting your research.

- Use the Search Tools Effectively: Utilize the search bar and other tools to efficiently identify the properties you’re interested in.

- Verify Information: Always double-check the information provided on the map against official records or contact the Assessor’s Office for clarification.

- Understand Legal Descriptions: Familiarize yourself with the legal descriptions used on the map to accurately identify property boundaries.

- Consider Additional Resources: Combine the Assessor’s Map with other resources, such as real estate websites, property records, or appraisal reports, for a comprehensive understanding of property information.

Conclusion

The Santa Fe County Assessor’s Map is an indispensable tool for anyone involved in property transactions, land management, or real estate research. By providing access to comprehensive property information, the map empowers users to make informed decisions, understand property values, and navigate the complexities of land ownership in Santa Fe County. The map’s user-friendly interface, comprehensive data, and readily accessible information make it an essential resource for a wide range of stakeholders.

Closure

Thus, we hope this article has provided valuable insights into Navigating Property Information in Santa Fe County: A Guide to the Assessor’s Map. We thank you for taking the time to read this article. See you in our next article!