Unlocking the Secrets of North Carolina Tax Maps: A Comprehensive Guide

Related Articles: Unlocking the Secrets of North Carolina Tax Maps: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Unlocking the Secrets of North Carolina Tax Maps: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Unlocking the Secrets of North Carolina Tax Maps: A Comprehensive Guide

- 2 Introduction

- 3 Unlocking the Secrets of North Carolina Tax Maps: A Comprehensive Guide

- 3.1 Understanding North Carolina Tax Maps

- 3.2 The Importance of North Carolina Tax Maps

- 3.3 Accessing North Carolina Tax Maps

- 3.4 Navigating North Carolina Tax Maps

- 3.5 Frequently Asked Questions (FAQs) about North Carolina Tax Maps

- 3.6 Tips for Using North Carolina Tax Maps Effectively

- 3.7 Conclusion

- 4 Closure

Unlocking the Secrets of North Carolina Tax Maps: A Comprehensive Guide

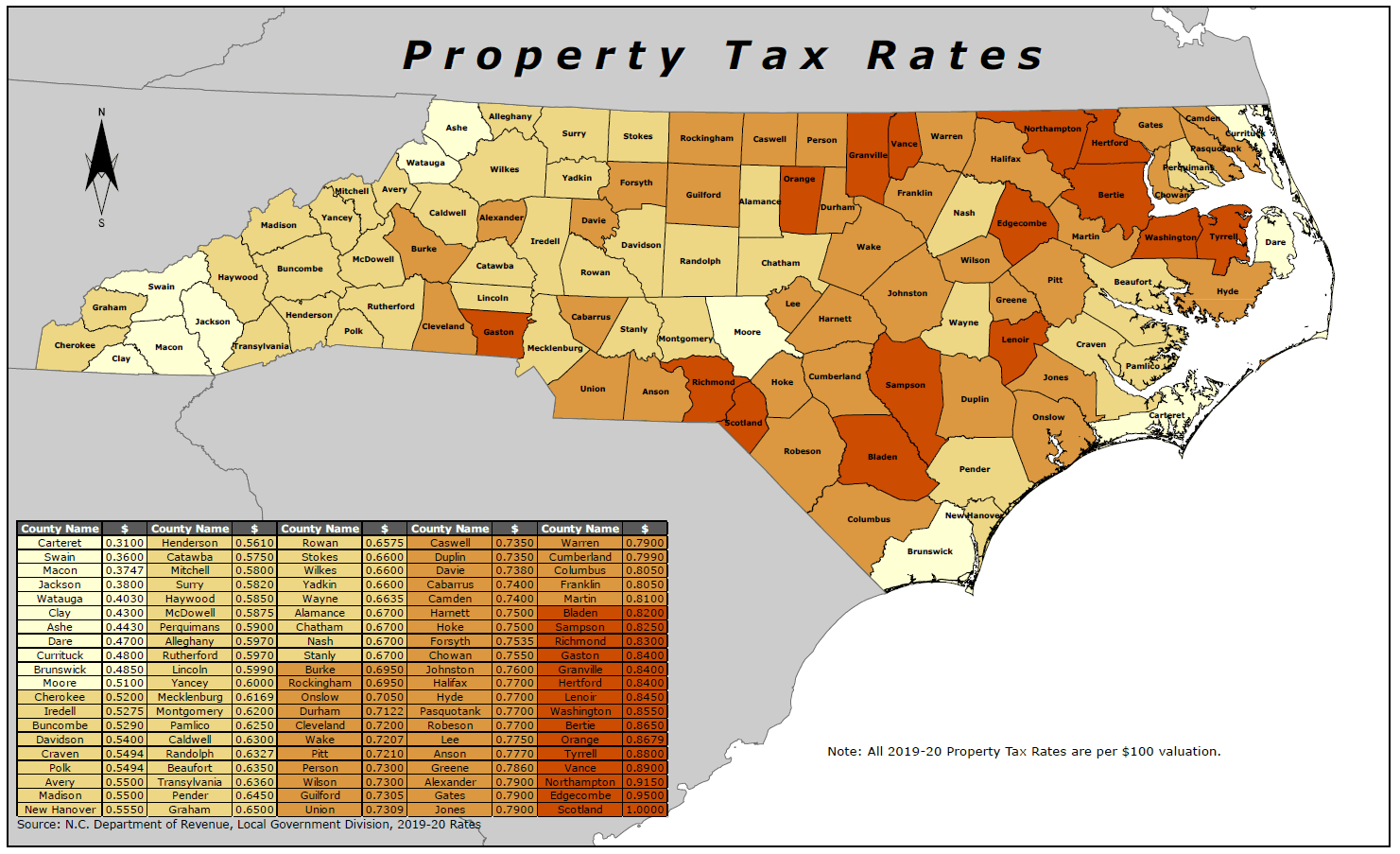

North Carolina’s tax maps are a vital tool for understanding property ownership, boundaries, and assessments. These detailed maps, maintained by county governments, serve as a foundational resource for various stakeholders, including property owners, real estate professionals, developers, and government agencies. This comprehensive guide delves into the intricacies of North Carolina tax maps, exploring their purpose, benefits, and how they can be accessed and utilized effectively.

Understanding North Carolina Tax Maps

Tax maps, often referred to as property maps, are graphical representations of land parcels within a county. They provide a visual overview of property boundaries, ownership information, and associated details, including:

- Parcel Identification Number (PIN): A unique identifier assigned to each property, serving as a primary reference point.

- Property Owner: The legal owner(s) of the property, as recorded in the county’s property records.

- Property Address: The official address assigned to the property.

- Land Use: The designated purpose of the property, such as residential, commercial, agricultural, or industrial.

- Property Value: The assessed value of the property for tax purposes.

- Zoning Information: The zoning regulations applicable to the property, outlining permitted uses and development restrictions.

The Importance of North Carolina Tax Maps

Tax maps are a cornerstone of property management and development in North Carolina, providing valuable information for a wide range of applications:

1. Property Ownership Verification: Tax maps offer a clear and reliable source for confirming property ownership, ensuring accurate identification of the legal owner.

2. Property Boundary Determination: They provide detailed depictions of property lines, aiding in resolving boundary disputes and ensuring accurate property descriptions.

3. Real Estate Transactions: Real estate professionals rely on tax maps to assess property value, understand zoning regulations, and identify potential development opportunities.

4. Development Planning: Developers use tax maps to identify suitable sites for construction projects, analyze land availability, and assess potential environmental impacts.

5. Property Tax Assessment: Tax maps serve as the foundation for property tax assessments, ensuring fair and equitable distribution of tax burdens based on property value.

6. Emergency Response: First responders use tax maps to navigate unfamiliar areas, locate specific properties, and identify potential hazards.

7. Public Access and Transparency: Tax maps promote transparency in government operations, allowing citizens to access information about property ownership, assessments, and land use regulations.

Accessing North Carolina Tax Maps

North Carolina tax maps are typically available through various channels, offering convenient access for users:

1. County Assessor’s Office: Most counties maintain online databases or physical map repositories at their assessor’s office, providing access to tax maps and related information.

2. County Government Websites: Many counties have dedicated sections on their official websites where tax maps are available for viewing and download.

3. Online Mapping Services: Commercial online mapping services, such as Google Maps or Bing Maps, often incorporate tax map data into their platforms, providing interactive and user-friendly access.

4. Geographic Information Systems (GIS): GIS software allows users to access and analyze tax map data, offering advanced visualization and spatial analysis capabilities.

Navigating North Carolina Tax Maps

Tax maps are often complex documents requiring a basic understanding of their structure and terminology:

- Legend: A key explaining symbols, colors, and abbreviations used on the map.

- Scale: The ratio between the map’s dimensions and the actual ground distance, indicating the map’s level of detail.

- Grid System: A network of lines or coordinates used for precise location referencing.

- Parcel Number: A unique identifier assigned to each property, typically displayed on the map.

- Property Boundaries: Lines representing the legal limits of each property.

- Land Use Symbols: Icons or abbreviations indicating the designated use of the property.

Frequently Asked Questions (FAQs) about North Carolina Tax Maps

1. How do I find the tax map for my property?

You can access tax maps through your county’s assessor’s office, their website, or online mapping services. You will typically need your property address or PIN to locate the relevant map.

2. What information can I find on a tax map?

Tax maps provide information about property boundaries, ownership, assessed value, land use, zoning regulations, and other relevant details.

3. Are tax maps always accurate?

While tax maps are generally accurate, errors can occur due to human error, outdated data, or changes in property boundaries. It is always advisable to verify information with the county assessor’s office.

4. How often are tax maps updated?

Tax maps are typically updated annually to reflect changes in property ownership, boundaries, or assessments. However, updates may vary depending on the county’s procedures.

5. Can I use tax maps for legal purposes?

Tax maps can provide valuable evidence in legal proceedings, such as boundary disputes or property ownership claims. However, it is essential to consult with an attorney to ensure their admissibility in court.

Tips for Using North Carolina Tax Maps Effectively

1. Understand the Purpose: Clearly define your objective before accessing the map, ensuring you are using the right tool for the task.

2. Verify Accuracy: Always verify information obtained from tax maps with the county assessor’s office or other reliable sources.

3. Utilize Available Resources: Explore online databases, GIS platforms, and other resources provided by your county or mapping services.

4. Seek Professional Assistance: If you encounter difficulties interpreting tax maps or require specialized information, consult a real estate professional or surveyor.

5. Stay Informed: Regularly check for updates to tax maps and changes in county policies or procedures.

Conclusion

North Carolina tax maps are invaluable tools for understanding property ownership, boundaries, and assessments. They provide a clear and accessible source of information for property owners, real estate professionals, developers, and government agencies. By leveraging these maps effectively, stakeholders can make informed decisions, navigate property transactions, and ensure responsible land management practices. As technology continues to evolve, online access and advanced mapping tools will further enhance the accessibility and utility of these essential resources, empowering individuals and organizations to unlock the secrets of North Carolina’s property landscape.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Secrets of North Carolina Tax Maps: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!